| # | Wallet | Type | Rating | Review | Check Wallet |

| 1 | Ledger Nano X | Cold (Hardware) | 4.8 | Review | Check Wallet |

| 2 | Trezor Model T | Cold (Hardware) | 4.7 | Review | Check Wallet |

| 3 | Tangem Wallet | Cold (Hardware) | 4.6 | Review | Check Wallet |

| 4 | SafePal S1 | Cold (Hardware) | 4.5 | Review | Check Wallet |

| 5 | MetaMask | Hot (Software) | 4.4 | Review | Check Wallet |

| 6 | Trust Wallet | Hot (Software) | 4.3 | Review | Check Wallet |

| 7 | ZenGo | Hot (Software) | 4.2 | Review | Check Wallet |

| 8 | Exodus | Hot (Software) | 4.1 | Review | Check Wallet |

| 9 | Coinbase Wallet | Hot (Software) | 4.0 | Review | Check Wallet |

| 10 | MyEtherWallet | Hot (Software) | 3.8 | Review | Check Wallet |

Understanding Crypto Wallets in 2025

Contrary to popular belief, crypto wallets don’t actually store your cryptocurrency. Instead, they safeguard the private keys that give you access to your assets on the blockchain. Think of your wallet as a secure interface that allows you to interact with various blockchain networks rather than a traditional container for funds.

Hot Wallets vs. Cold Wallets

The crypto wallet ecosystem is divided into two main categories:

Hot Wallets

- Connected to the internet (mobile apps, browser extensions)

- Convenient for frequent transactions

- Usually free to download and use

- Ideal for active traders and smaller amounts

Cold Wallets

- Offline storage devices (hardware wallets)

- Maximum security for long-term holdings

- One-time purchase cost

- Best for storing larger crypto investments

Security Considerations for 2025

The threat landscape has evolved significantly, with sophisticated attacks targeting both individual users and major platforms. When evaluating wallets in 2025, consider these critical security factors:

- Private Key Management: Who controls your keys? Self-custody (non-custodial) wallets give you full control.

- Multi-Factor Authentication: Additional security layers beyond passwords.

- Backup Solutions: Methods for recovery if your device is lost or damaged.

- Open-Source Code: Transparency that allows community verification.

- Security Audits: Third-party validation of security measures.

Best Hardware Wallets of 2025

Hardware wallets represent the gold standard for cryptocurrency security. These physical devices store your private keys offline, making them virtually immune to online hacking attempts. Here are the top hardware wallets of 2025:

Ledger Nano X

The Ledger Nano X continues to dominate the hardware wallet market in 2025, offering an exceptional balance of security and functionality. This Bluetooth-enabled device supports over 5,500 cryptocurrencies and connects seamlessly to the Ledger Live mobile app, allowing for convenient management of your portfolio even while on the move.

Pros

- CC EAL5+ certified secure element chip

- Bluetooth connectivity for mobile management

- Supports 5,500+ cryptocurrencies

- Large capacity for up to 100 applications

- Built-in battery for on-the-go use

Cons

- Higher price point ($149)

- Closed-source firmware

- Bluetooth connectivity introduces potential attack vectors

- Steeper learning curve for beginners

Best For: Experienced crypto investors managing diverse portfolios who need mobile access to their cold storage.

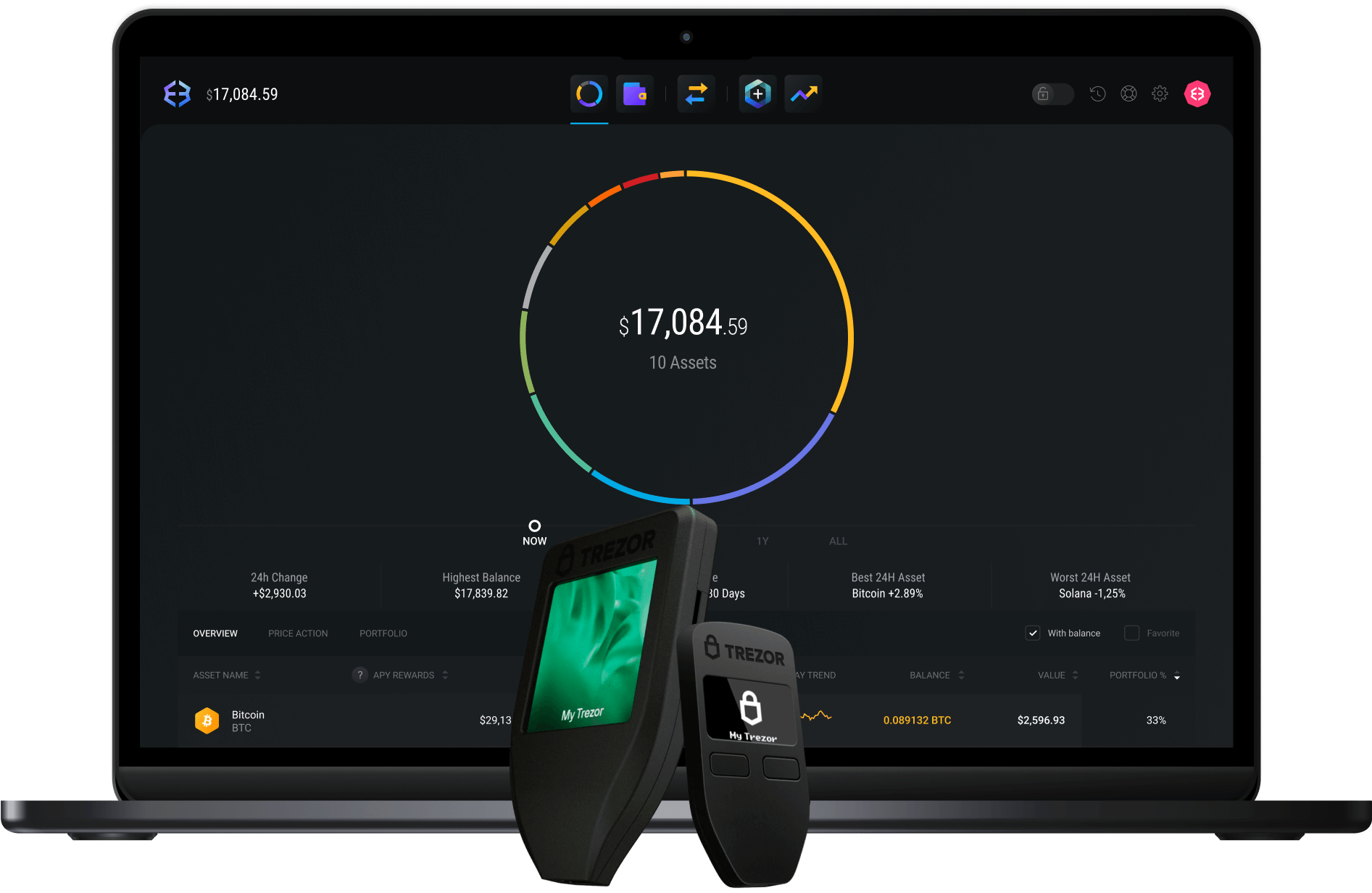

Trezor Model T

The Trezor Model T stands out in 2025 as the premier open-source hardware wallet, offering unparalleled transparency and security. Its intuitive touchscreen interface simplifies the user experience, while the device’s robust security architecture provides peace of mind for serious investors.

Pros

- Fully open-source firmware and hardware

- Intuitive color touchscreen interface

- Supports 1,800+ cryptocurrencies

- Password manager functionality

- No battery to degrade over time

Cons

- Premium pricing ($219)

- No wireless connectivity options

- Larger physical size than competitors

- Limited support for some newer blockchains

Best For: Security-focused users who value open-source transparency and prefer a touchscreen interface.

Tangem Wallet

Tangem offers a unique approach to hardware wallets in 2025 with its NFC-enabled smart card design. Unlike traditional hardware wallets, Tangem eliminates seed phrases entirely, replacing them with a patented smart backup technology that enhances both security and user experience.

Pros

- EAL6+ CC certified security chip

- No seed phrases to manage

- Ultra-thin card format fits in your wallet

- Supports 80+ blockchain networks

- Waterproof and extremely durable

Cons

- Requires NFC-enabled smartphone

- Mobile app only (no desktop version)

- Limited history compared to competitors

- Fewer supported assets than Ledger

Best For: Mainstream users seeking simplicity and security without the complexity of seed phrases.

SafePal S1

The SafePal S1 has carved out a niche in 2025 as the most affordable hardware wallet that doesn’t compromise on security. This air-gapped device uses QR codes for transaction signing, eliminating all network connections and significantly reducing potential attack vectors.

Pros

- Budget-friendly price point ($49.99)

- Completely air-gapped security

- Supports 10,000+ cryptocurrencies

- Backed by Binance ecosystem

- Self-destructing mechanism if tampered with

Cons

- Smaller screen with basic interface

- QR code transactions less convenient

- Limited battery life

- Less established brand history

Best For: Budget-conscious investors seeking hardware-level security at an entry-level price.

Best Software Wallets of 2025

Software wallets offer convenience and accessibility for day-to-day cryptocurrency management. While not as secure as hardware solutions, the best software wallets of 2025 implement robust security measures while providing seamless user experiences. Here are our top picks:

MetaMask

MetaMask remains the dominant force in Web3 wallets for 2025, serving as the gateway to Ethereum and all EVM-compatible blockchains. Its widespread adoption and seamless integration with thousands of decentralized applications make it essential for anyone exploring DeFi, NFTs, or other Ethereum-based services.

Pros

- Seamless integration with 3,700+ dApps

- Available as browser extension and mobile app

- Built-in token swaps and NFT support

- Robust security with frequent updates

- Extensive educational resources

Cons

- Limited to Ethereum and EVM chains

- No native Bitcoin support

- Complex gas fee system for beginners

- Higher target for phishing attempts

Best For: DeFi enthusiasts, NFT collectors, and anyone regularly interacting with Ethereum-based applications.

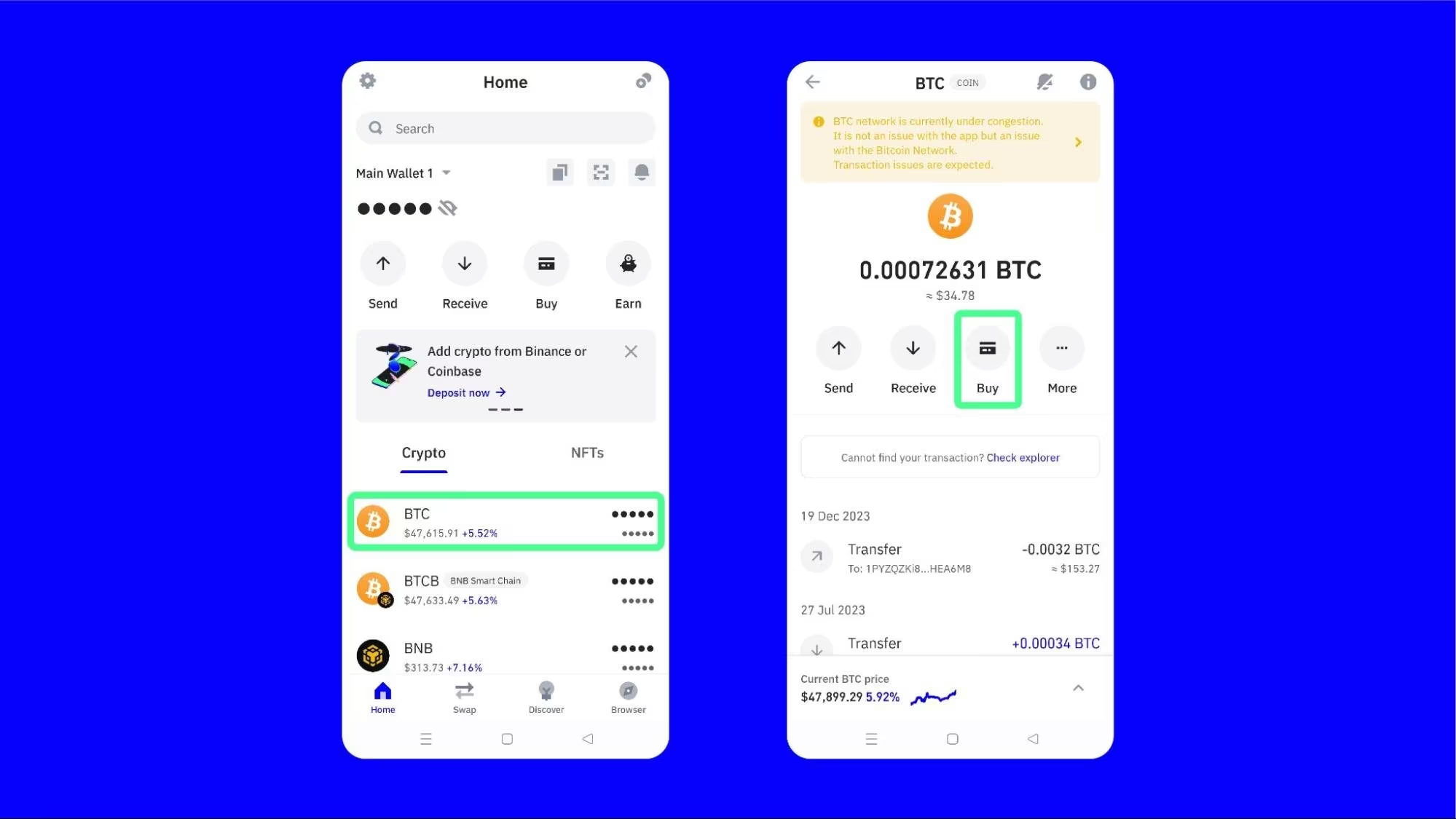

Trust Wallet

Trust Wallet has evolved into the most versatile mobile-first crypto wallet of 2025, supporting an impressive range of blockchains and tokens. Backed by Binance, this non-custodial wallet combines extensive asset support with an intuitive interface that appeals to both beginners and experienced users.

Pros

- Supports 70+ blockchains and thousands of tokens

- Native NFT viewing and management

- Built-in DApp browser and token swaps

- Staking options for multiple cryptocurrencies

- Open-source codebase

Cons

- Mobile-focused with limited desktop functionality

- Higher swap fees than dedicated exchanges

- Limited customer support options

- Occasional performance issues with many assets

Best For: Mobile-centric users managing diverse crypto portfolios across multiple blockchains.

ZenGo

ZenGo has revolutionized the wallet space in 2025 with its innovative keyless security model. Using advanced MPC (Multi-Party Computation) cryptography, ZenGo eliminates the vulnerability of seed phrases entirely, replacing them with facial biometrics and sophisticated mathematical safeguards.

Pros

- No seed phrases or private keys to manage

- Facial biometric authentication

- 24/7 live customer support

- Simple, intuitive interface

- Built-in Web3 wallet capabilities

Cons

- Supports fewer cryptocurrencies than competitors

- Higher in-app exchange fees

- Reliance on facial recognition technology

- Mobile-only with no desktop option

Best For: Beginners and security-conscious users who want to avoid the complexity of seed phrase management.

Exodus

Exodus continues to set the standard for desktop crypto wallets in 2025, combining visual appeal with powerful functionality. Its intuitive design and extensive feature set make it particularly appealing to users who prefer managing their crypto on larger screens while still having mobile access when needed.

Pros

- Supports 250+ cryptocurrencies

- Beautiful, intuitive interface

- Built-in exchange functionality

- Desktop and mobile synchronization

- Trezor hardware wallet integration

Cons

- Higher exchange fees than dedicated platforms

- Limited customization for transaction fees

- Not fully open-source

- No built-in Web3 dApp browser

Best For: Desktop-first users who value visual design and ease of use across multiple devices.

Coinbase Wallet

Coinbase Wallet has established itself as the bridge between centralized and decentralized finance in 2025. While separate from the Coinbase exchange, this non-custodial wallet benefits from the company’s strong security reputation while offering full self-custody of your crypto assets.

Pros

- Trusted brand with strong security track record

- Seamless fiat on-ramps

- User-friendly interface for beginners

- Robust dApp browser

- Cloud backup options for recovery

Cons

- Less privacy than other non-custodial wallets

- Higher network fees for some transactions

- Limited advanced features for power users

- Occasional sync issues with Coinbase exchange

Best For: Coinbase exchange users and newcomers to self-custody who value brand recognition and simplicity.

MyEtherWallet (MEW)

MyEtherWallet (MEW) remains the most comprehensive web-based solution for Ethereum management in 2025. As one of the original Ethereum wallets, MEW has evolved to offer advanced functionality while maintaining its commitment to user sovereignty and security.

Pros

- No downloads required (web-based)

- Hardware wallet compatibility

- Advanced Ethereum functionality

- DApp integration

- Open-source codebase

Cons

- Ethereum-focused with limited multi-chain support

- Steeper learning curve for beginners

- Web interface more vulnerable to phishing

- Less intuitive than newer wallet options

Best For: Experienced Ethereum users who need advanced functionality and prefer web-based solutions.

Crypto Wallet Comparison Table 2025

To help you make an informed decision, we’ve compiled this comprehensive comparison of the best crypto wallets of 2025, highlighting key features and specifications:

| Wallet | Type | Platform | Assets Supported | Ease of Use | Price | Best For |

| Ledger Nano X | Cold (Hardware) | iOS, Android, Desktop | 5,500+ | Moderate | $149 | Diverse portfolios |

| Trezor Model T | Cold (Hardware) | Desktop | 1,800+ | Moderate | $219 | Security purists |

| Tangem Wallet | Cold (Hardware) | iOS, Android | 1,000+ | High | $59 | Simplicity seekers |

| SafePal S1 | Cold (Hardware) | iOS, Android | 10,000+ | Moderate | $49.99 | Budget security |

| MetaMask | Hot (Software) | Browser, iOS, Android | EVM chains only | Moderate | Free | DeFi & dApps |

| Trust Wallet | Hot (Software) | iOS, Android | Multi-chain (70+) | High | Free | Mobile users |

| ZenGo | Hot (Software) | iOS, Android | 100+ | Very High | Free | Beginners |

| Exodus | Hot (Software) | Desktop, iOS, Android | 250+ | High | Free | Desktop users |

| Coinbase Wallet | Hot (Software) | iOS, Android, Browser | Multi-chain | Very High | Free | Coinbase users |

| MyEtherWallet | Hot (Software) | Web, iOS, Android | Ethereum ecosystem | Low | Free | ETH power users |

How to Choose the Right Crypto Wallet in 2025

Selecting the ideal crypto wallet depends on your specific needs and circumstances. Consider these key factors when making your decision:

Security Requirements

The value and nature of your holdings should dictate your security approach:

- Large holdings ($10,000+): Hardware wallets are essential

- Medium holdings: Consider a mix of hardware and software wallets

- Small holdings: Software wallets may be sufficient

- Active trading: Keep only trading amounts in hot wallets

User Experience Needs

Your technical comfort level matters significantly:

- Beginners: ZenGo, Coinbase Wallet, or Tangem

- Intermediate: Trust Wallet, Exodus, or Ledger

- Advanced: Trezor, MetaMask, or MyEtherWallet

Asset Compatibility

Ensure your wallet supports your current and future investments:

- Bitcoin only: Specialized Bitcoin wallets offer enhanced features

- Ethereum ecosystem: MetaMask or MyEtherWallet excel here

- Multi-chain: Trust Wallet or hardware options provide flexibility

- NFTs: Ensure native NFT support if collecting digital assets

Additional Features

Consider these extra capabilities based on your needs:

- Staking: For earning passive income on proof-of-stake assets

- DApp browser: For interacting with decentralized applications

- Exchange integration: For convenient trading functionality

- Multi-signature: For shared control of assets

Expert Tip: The Multi-Wallet Strategy

Many experienced crypto users employ a tiered approach to wallet security:

- Cold storage: Hardware wallet for long-term holdings and large amounts

- Hot wallet: Software wallet for active trading and smaller amounts

- Exchange accounts: Only for immediate trading needs

This strategy balances security with convenience while minimizing risk exposure.

Security Best Practices for Crypto Wallets in 2025

Protect Your Private Keys

- Never share your private keys or seed phrases with anyone

- Store backup phrases offline in secure locations

- Consider metal backups for fire/water resistance

- Split seed phrases across multiple secure locations

Secure Your Devices

- Use strong, unique passwords for all wallet accounts

- Enable biometric authentication when available

- Keep software and firmware updated

- Use dedicated devices for large crypto holdings

Practice Safe Habits

- Verify all transaction details before confirming

- Start with small test transactions to new addresses

- Be vigilant against phishing attempts

- Use hardware wallets for transactions over $1,000

Critical Warning: Beware of Scams

The crypto space continues to attract sophisticated scammers. Always:

- Download wallets only from official websites or app stores

- Verify URLs carefully (bookmark official sites)

- Never enter seed phrases on websites

- Be suspicious of unexpected “support” messages

- Ignore offers that seem too good to be true

Frequently Asked Questions About Crypto Wallets

What is the safest crypto wallet in 2025?

Hardware wallets like Ledger Nano X, Trezor Model T, and Tangem provide the highest level of security by keeping private keys offline. Among these, Trezor’s open-source approach offers additional transparency, while Ledger’s secure element provides robust hardware protection. For maximum security, combine a hardware wallet with proper security practices like offline backup storage and regular firmware updates.

Are hardware wallets safer than mobile wallets?

Yes, hardware wallets are generally safer than mobile wallets because they store private keys offline, making them immune to online attacks. Mobile wallets, while convenient, are connected to the internet and therefore more vulnerable to malware, phishing, and remote hacking attempts. However, high-quality mobile wallets with strong security features can still provide adequate protection for smaller amounts of cryptocurrency.

Can I stake crypto with MetaMask or Trust Wallet?

Yes, both MetaMask and Trust Wallet support staking for various cryptocurrencies in 2025. MetaMask allows staking through connected dApps for Ethereum and other EVM-compatible proof-of-stake networks. Trust Wallet offers native staking functionality for multiple blockchains including Ethereum, Solana, Polkadot, and Cosmos. The available staking options and rewards vary by blockchain, so it’s worth comparing the specific assets you wish to stake.

What happens if I lose my hardware wallet?

If you lose your hardware wallet but have properly backed up your recovery seed phrase, you can restore your wallet and access your funds on a new device. This is why securely storing your seed phrase offline is critical. Without the recovery phrase, your cryptocurrency would be permanently lost. Most hardware wallets use a standard called BIP39, allowing recovery across different wallet brands that support the same standard.

How do I transfer crypto from an exchange to a wallet?

To transfer cryptocurrency from an exchange to your wallet:

- Copy your wallet’s receiving address for the specific cryptocurrency

- Go to your exchange account and navigate to the withdrawal section

- Select the cryptocurrency you wish to withdraw

- Paste your wallet address and verify it’s correct

- Enter the amount to transfer

- Confirm the transaction and complete any security verifications

Always send a small test transaction first when using a new address for the first time.

Which wallet is best for NFTs in 2025?

For NFT collectors in 2025, MetaMask remains the top choice for Ethereum-based NFTs due to its seamless integration with major marketplaces like OpenSea and Rarible. Trust Wallet offers excellent multi-chain NFT support with a user-friendly gallery view. For Solana NFTs, Phantom Wallet provides the best experience with native marketplace connections. Hardware wallet users should consider Ledger, which offers NFT visualization through Ledger Live while maintaining cold storage security.

Conclusion: Securing Your Crypto Future in 2025

As cryptocurrency adoption continues to grow in 2025, choosing the right wallet is more important than ever. The best approach combines security with usability based on your specific needs:

- For maximum security: Hardware wallets like Ledger, Trezor, or Tangem remain the gold standard

- For everyday convenience: Software wallets like MetaMask, Trust Wallet, or ZenGo offer accessibility

- For optimal balance: Consider a multi-wallet strategy with both hardware and software solutions

Remember that no wallet is completely immune to user error. Following security best practices is just as important as your choice of wallet. Stay informed about emerging security threats, keep your software updated, and never share your private keys or seed phrases with anyone.

Stay Updated on Crypto Wallet Security

The cryptocurrency landscape evolves rapidly. Subscribe to our newsletter for the latest wallet security updates, feature comparisons, and expert recommendations to keep your digital assets safe in 2025 and beyond.

Subscribe to Wallet Security Updates

Best No Tax Cryto Wallet